Counting Pounds and Pence: Being a Low-Income Student in London

On my second day in London, the English orientation staff joked that Londoners have the perception that Americans are born with a gold Amex card in hand. Although the room erupted in laughter, I knew it was very likely that a few of the one hundred or so Americans studying in London with me this semester were from backgrounds of privilege similar to the one described; a background completely different from my own.

I try to remind myself that what I really want to get out of my semester abroad are experiences, not things.

As someone from a low-income household, I had never considered it a possibility that I would be spending a semester studying in the libraries of London and exploring the European continent in my spare time. However, now that it is a reality, I am determined to make the most of it even if I have to count some dollars and cents—or should I say pounds and pence—as I go along.

Prepare by Searching for Savings Everywhere

Thankfully, my college has an excellent study abroad financial aid policy that covered my tuition and the bulk of the fees associated with my semester at the University College London. However, during my time abroad I would still have to figure out how I would account for expenses that I usually do not worry about at my home institution. I would have to pay for and/or prepare all of my meals on the weekends and during the lunch hour on the weekdays. Additionally, while abroad I knew that I would spend significantly more money on entertainment, leisure activities, and outside travel and that I would have to pick up numerous souvenirs or face the wrath of all my friends and family once I returned to the States.

To help me plan for how I would cover these costs, I reached out to other students from my home university who had studied abroad in London. Through them I learned that because I already used Bank of America, I was able to take advantage of their consortium agreement with the U.K. bank Barclays and avoid costly international transaction fees. They advised me to create a Groupon account for London so that I could get daily updates on deals for cheap food and travel near me, that I should not be shy about using my University ID card to ask for student discounts, and that the cost of take-away at restaurants is often times cheaper than dining in.

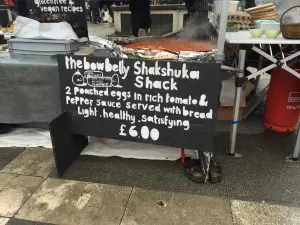

I tuned into orientation webinars that the University College London’s International Student Orientation Program held prior to my arrival in the U.K. From these webinars I learned about the most affordable places to buy food near campus (i.e. Aldi, Lidl), that buses were the cheapest way to get around the city, and that every Thursday there is a farmers market right next to campus that sells fresh produce and incredible food like delicious £4.50 burgers and £6.50 personal pizzas. Good old Google helped me to identify the tips and tricks of London students on a budget, like shopping at Primark for everything from trendy clothes to cheap linens.

Make a Budget and Stick to It

Yet still, the biggest challenge of my semester abroad would be sticking to these cost effective tips and minding my budget. So before I left for the U.K., I found an online study abroad financial spreadsheet suggested by Emory College’s Office of International and Summer Programs and edited it to reflect my spending habits. Now all I have to do is quickly plug in my spending at the end of each day so that I can monitor my budget. I also researched cheap ways to have fun on a budget in London and learned that none of London’s museums charge an entry fee and that there are several parks and gardens, like the beautiful Regents Park, open to the public.

Before I left I also made a promise to myself that I would not blow my budget on shopping. While this promise has been hard to keep, especially because I am spitting distance away from Oxford Street, a paradise for retail therapy, I try to remind myself that what I really want to get out of my semester abroad are experiences, not things. However, I also made sure to leave room for the unplanned spending that would undoubtedly occur. I always remind myself that if I overshoot my budget by a few pounds I should not freak out.

It is possible to be low-income abroad even in an expensive city like London. It will be tough, especially if your college is not particularly generous when it comes to study abroad, but it can be done. By doing some prior research, making the most of your resources, and remembering to spend money on memories and not materials you can have an amazing experience with or without a gold Amex card.